What if you can’t get long-term-care insurance? There are still a few options.

Long-term-care insurance should be be a crucial part of your retirement planning. After all, 49% of men and 64% of women reaching age 65 today will need significant long-term care, according to the Department of Health and Human Services, and 14% will need more than two years of paid care at an average cost of $120,900.

Extended illnesses are major contributor to bankruptcies among older Americans. According to one survey 1 in 7 people who filed for bankruptcy was aged 65 or older, and one of the leading causes was health care costs.

The problem is many don’t think about long-term-care until it’s too late. “The vast majority of long-term-care insurance sales happens for people between 60 and 70,” says Chris Orestis, president, Retirement Genius, an online retirement resource. “But as is the case with any purchase of an insurance product, it’s going to be factored around your health in the underwriting. People will kick the can down the road, and then a health event will happen. They think, now, I better go buy that long-term-care insurance. And then they are uninsurable. If there are health factors when they’re underwritten, they’re going to be denied.”

The best option is to buy long-term-care insurance when you are younger, when the rates are lowest. But even that isn’t hasn’t always worked out.

“Many of my clients have long-term-care insurance, or we’ve crunched some numbers and look for other ways,” says Steve Pedicini, senior wealth advisor at AlphaCore Wealth Advisory in La Jolla, California. “But even the ones that have policies are still having to evaluate regularly, because the insurance companies have petitioned the states and been able to enact massive increases on policy premiums, and people are left to decide whether they keep the insurance or lower the coverage.”

If you don’t qualify

For those who don’t qualify for long-term care insurance, there are options. Among them:

- The VA Aid and Attendance Benefit. If you are a veteran, you could qualify for monthly benefits through the VA Aid and Attendance Benefits and Household allowance. Benefits amounts of $2,358 for long-term care, an assisted living facility or aging in place would be on top of your monthly VA benefit, says Orestis. If you were married to a veteran who is deceased, you could qualify for benefits of $1,515 a month, he says. “Once you’re approved, that’s a lifetime benefit,” he says. “And every year it’s subject to an annual (inflation) adjustment.”

- Self-funding. “You want to be thinking about that when you’re in your 20s and thinking about how much you need to put away, because you might have to self-insure and actually pay for things out of pocket, and I think that’s what a lot of people are having to do,” says Jennifer Belmont Jennings, attorney at MGD Law in St. Louis, Missouri. The first issue is getting a sense of if there are health concerns?” says Pedicini. Review your family health history, to get a sense for if there are illness that requires long-term care. Run the numbers looking at sources of income such as Social Security, pensions and annuities. And then look at expenditures. “What would that look like if you had a long-term care event?”

- Workplace plans. It may not be an option for some older workers, but if you are still working, your employer might offer a group plan. “It’s worth investigating whether they can sign up for that plan and if that plan would be portable,” says Pedicini. “If they ever were to retire or separate from the employer, would they be able to take that with it? What would be the for premiums going forward?”

- A life settlement. A life settlement involves selling a life insurance policy to a third party. “An institutional investor, a big hedge funds, investment groups, investment banks that will buy people’s life insurance policies from them while they’re still alive for a percentage of the death benefit, and then they will take over the premium payment Orestis,” says. “The policy owner will receive some percentage of the death benefit as a cash payment while they’re still alive, which they and then free to use to pay for care.”

- A reverse mortgage. Though many financial planners will only recommend them as a last resort, a reverse mortgage is a way to take equity out of your home to get the cash needed for long-term care. That money can come in the form of a lump sum or monthly payments. Of course, when the homeowner dies, the money has to be repaid, usually by selling the home. For those who want to pass generational wealth to their children and grandchildren through their homes, this is not a viable option.

- Hybrid products. “There are new hybrid products that are out there that incorporate both an insurance component, like a life insurance component, and a long-term-care insurance component,” says Jennings. “I think those can be worth talking to an insurance expert about to see if they make sense. You have to be careful with insurance, though. You really do want to do some research and make sure you know, you understand the company that you’re purchasing from. Are they solvent? What’s their track record? Is it a new place that popped up on the internet? There are insurance experts who do help out with this.”

- Use an annuity. Orestis says people who receive income from an annuity can direct that annuity income towards their care needs. “Assisted living communities, home care companies, nursing homes, will all recognize that that is an income stream that is guaranteed. It could actually be directed to pay to the care provider directly, or you could administer your money and pay them yourself.”

YOUR TURN

Have you had any issues obtaining Long Term Care Insurance? Did you have it and cancel – and if so why? Are you happy with the LTC you have? Let us know in the comments!

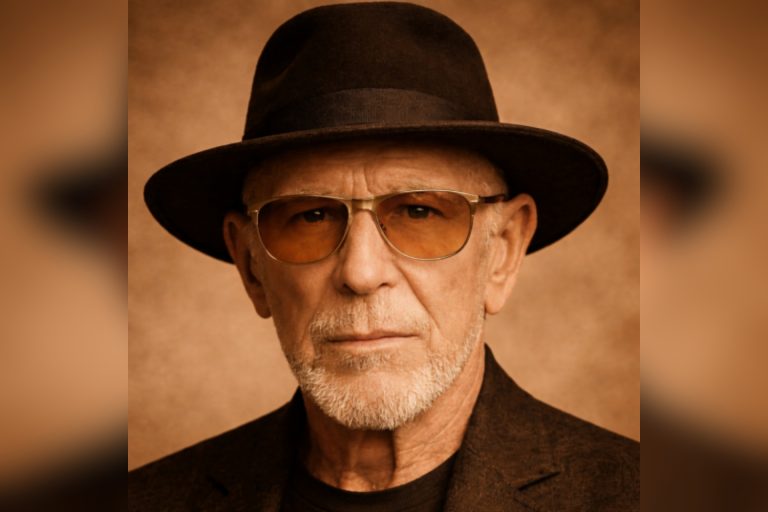

Rodney A. Brooks is an award-winning journalist and author. The former Deputy Managing Editor/Money at USA TODAY, his retirement columns appear in U.S. News & World Report and Senior Planet.com. He has also written for National Geographic, The Washington Post and USA TODAY and has testified before the U.S. Senate Special Committee on Aging. His book, “The Rise & Fall of the Freedman’s Bank, And Its Lasting Socio-economic Impact on Black America” was released in 2024. He is also author of the book “Fixing the Racial Wealth Gap.” His website is www.rodneyabrooks.com

Rodney A. Brooks is an award-winning journalist and author. The former Deputy Managing Editor/Money at USA TODAY, his retirement columns appear in U.S. News & World Report and Senior Planet.com. He has also written for National Geographic, The Washington Post and USA TODAY and has testified before the U.S. Senate Special Committee on Aging. His book, “The Rise & Fall of the Freedman’s Bank, And Its Lasting Socio-economic Impact on Black America” was released in 2024. He is also author of the book “Fixing the Racial Wealth Gap.” His website is www.rodneyabrooks.com

Your use of any financial advice is at your sole discretion and risk. Seniorplanet.org and Older Adults Technology Services from AARP makes no claim or promise of any result or success.

COMMENTS

2 responses to “If You Can’t Get Long-Term Care Insurance…”

Funding long term care is a quagmire I wouldn’t wish on anyone and the comment from NC is right on point. Medicaid is a labyrinth to come to and oh, does it ever require money upfront. Just one more broken spoke on the wheel of our health care system.

Good article. My husband and I took out a plan with an inflation factor around age 60 that would cover half the cost of assisted living in NC at the time. We have lowered the time covered to 3 years to keep costs manageable. But I am POA for a friend with some dementia, an income of 5k/month, and no assets. None of the options you list work for her. She could qualify for Medicaid in a nursing home, but you have to be in one first to start the process. And that costs $ up front.

Sign Up for Newsletters

There’s always a lot going on in the Senior Planet universe. Get our newsletters to make sure you never miss a thing!

Sign Up Now

Join Senior Planet Community

Senior Planet Community is our social media platform designed specifically for older adult users. Engage in thought-provoking discussions, make new friends, and share resources all on a safe and ad-free platform.

Join the Conversation Today

Upcoming Online Classes

Events

Calendar of Events

Start your week off right with a preview of the week's upcoming programs and a guided meditation session!

Start your day with a short morning stretch!

Registration required.

Discover what you can do with online and mobile banking!

Use bodyweight, bands, and dumbbells to build your strength.

Learn about devices and apps that can help you get more Zzz's

Activate the joints and muscles and increase mental focus during this exercise class.

Start your day with a short morning stretch!

Come learn how your phone can count your steps and check your heart rate!

TikTok can be a source of fun, creativity, and information. Learn about this social media platform gaining popularity.

Follow various cues to develop body alignment and breath awareness.

Start your day with a short morning stretch!

Registration required.

You CAN leave home without your wallet! Learn about popular digital wallets and their many uses.

Use bodyweight, bands, and dumbbells to build your strength.

Join Senior Planet and our tour guides from Discover Live for a virtual visit to Louisiana!

Get your heart pumping during this fun, high-energy workout!

Activate the joints and muscles to become limber and increase balance during this exercise class.

Start your day with a short morning stretch!

Learn about tech you can wear and what it can do for you!

Registration required.

Curious about your family's history? Fill in the gaps using digital genealogy resources!

Looking for a new creative outlet? Learn about popular, free platforms to design cards, flyers, and more online.

Join this special class that combines gentle movement with a focus on harmonizing your mind, body and breath.

Start your day with a short morning stretch!

Don't want to pay for software? Learn how Google's free tools have you covered.

¡Consiga hacer algo más que figuras de palitos y haga que su imaginación cobre vida con generadores de imágenes de IA!

Relax your mind and strengthen your body with this gentle exercise class.

Join this session for a fun workout that will boost your strength, flexibility, and mobility!

Come learn how smart technology can help you maintain your independence in your own home.

Don't want to cook? Learn about meal kit services that take the stress out of meal time!

Don't want to go out? Learn about some popular apps to get food delivered to your front door.

Start your week off right with a preview of the week's upcoming programs and a guided meditation session!

Start your day with a short morning stretch!

Use bodyweight, bands, and dumbbells to build your strength.

Registration required.

Learn how to use emojis, GIFs, and more to quickly say what you mean!

Get your heart pumping during this fun, high-energy workout!

Activate the joints and muscles and increase mental focus during this exercise class.

Start your day with a short morning stretch!

See who you are talking to with video chat apps!

Ready to ditch the filling cabinet and store your documents virtually? Join this lecture on Digital Vaults to learn how!

Follow various cues to develop body alignment and breath awareness.

Start your day with a short morning stretch!

Thinking about hosting a group video call? Come to this lecture for an overview of hosting Zoom meetings.

Use bodyweight, bands, and dumbbells to build your strength.

Get your heart pumping during this fun, high-energy workout!

Registration required.

Goodbye floppy discs and USB drives! Learn about cloud storage options that save your files remotely.

Activate the joints and muscles to become limber and increase balance during this exercise class.

Start your day with a short morning stretch!

Learn about online tools to jump-start your start-up.

Registration required.

Overwhelmed by the choices of a new computer? We'll help you simplify so you can decide!

Learn what Podcasts are and where to find them!

Join this special class that combines gentle movement with a focus on harmonizing your mind, body and breath.

Start your day with a short morning stretch!

Stumped? Find what you're looking for on Reddit!

¡No tenga miedo, porque la IA está aquí... ¡para (intentar a) ayudar!

Relax your mind and strengthen your body with this gentle exercise class.

Activate the joints and muscles and increase mental focus during this exercise class.

Start your day with a short morning stretch!

Registration required.

Don't want to pay for software? Learn how Google's free tools have you covered.

Learn how to keep your MyChart and other health accounts secure and private!

Follow various cues to develop body alignment and breath awareness.

Start your day with a short morning stretch!

Caregiving is hard, but tech tools can make it easier! Join us in this lecture to find out how.

Use bodyweight, bands, and dumbbells to build your strength.

Registration required.

Where can you find cute pets, news, how-to videos, and more? YouTube, of course! Join us for an intro to YouTube.

Take a virtual tour of Washington, DC with Senior Planet and Discover Live to explore Dr. King’s legacy on the National Mall.

Activate the joints and muscles to become limber and increase balance during this exercise class.

Start your day with a short morning stretch!

Tired of juggling paperwork, deadlines, and day-to-day chaos? Discover the user-friendly software tools that can bring clarity, control, and peace of mind to your business.

Stay independent and on the move! Discover how Lyft Silver makes getting around easy without needing to drive.

Stay sharp with technology! Join this lecture to learn about different ways to engage your brain.

Join this special class that combines gentle movement with a focus on harmonizing your mind, body and breath.

Start your day with a short morning stretch!

Puede que ver ya no signifique creer. Venga a aprender a identificar ultrafalsos (deepfakes) y voces clonadas para no caer en el engaño digital.

Love the great outdoors? Come learn how smartphone apps can enhance your outdoor hobbies!

Relax your mind and strengthen your body with this gentle exercise class.

Join this session for a fun workout that will boost your strength, flexibility, and mobility!

Come learn how your phone can count your steps and check your heart rate!

Don't just Google it! Use these reputable health info websites instead.

Learn how fitness apps can help you track and conquer your goals!

Start your week off right with a preview of the week's upcoming programs and a guided meditation session!

Start your day with a short morning stretch!

Registration required.

Come learn about QR codes, augmented reality apps, and more!

Use bodyweight, bands, and dumbbells to build your strength.

Will your digital content and social media pages live on forever? Come learn about your digital legacy options!

Activate the joints and muscles and increase mental focus during this exercise class.

Start your day with a short morning stretch!

Registration required.

Are you scam savvy? Come to this lecture to learn about fraud and scams and how to protect yourself against them.

Are you paying for TV channels you don't watch? Learn why people are "cutting the cord" and using streaming services instead!

Follow various cues to develop body alignment and breath awareness.

Start your day with a short morning stretch!

Registration required.

Faster is not always better! Come learn about home internet options so you only pay for what you need.

Use bodyweight, bands, and dumbbells to build your strength.

Get your heart pumping during this fun, high-energy workout!

Learn what Podcasts are and where to find them!

Activate the joints and muscles to become limber and increase balance during this exercise class.

Start your day with a short morning stretch!

Learn how to stay safe while you surf the web!

Learn about platforms that make website building a breeze!

Concerned about viruses and malware? Attend this lecture to learn how to keep your device safe!

Join this special class that combines gentle movement with a focus on harmonizing your mind, body and breath.

Start your day with a short morning stretch!

Explore ways that tech can help you save money and manage your finances!

¿La IA hizo eso? ¡Venga a aprender sobre las herramientas de voz y video de IA!

Relax your mind and strengthen your body with this gentle exercise class.

Learn about tech you can wear and what it can do for you!

Use bodyweight, bands, and dumbbells to build your strength.

Learn about devices and apps that can help you get more Zzz's

Interested in meditation? Learn about the app's meditative sleep aids and how to connect with others who have similar goals in the Insight Timer Community!

Good Morning, Senior Planet!

Morning Stretch

Banking and Finance Apps at a Glance

Functional Strength Training

Intro to Sleep Technologies

Good Morning, Senior Planet!

Morning Stretch

Banking and Finance Apps at a Glance

Functional Strength Training

Intro to Sleep Technologies

Stronger Bones

Morning Stretch

Mobile Health Apps

Intro to TikTok

Chair Yoga

Morning Stretch

Introduction to Digital Wallets

Functional Strength Training

Virtual Tour: Mardi Gras, New Orleans, LA

Fit Fusion Workout

Balance/Strength

Morning Stretch

Wearables at a Glance

Digital Genealogy Tools

Graphic Design Tools

Qigong Flow

Morning Stretch

Google Workspace

Generadores de imágenes de IA

Taijiquan (Tai Chi)

Saturday Morning Boost: A Fun and Functional Workout

Technology for Aging in Place

Meal Kit Services

Food Delivery Apps

Good Morning, Senior Planet!

Morning Stretch

Functional Strength Training

Emojis, GIFs, and more!

Fit Fusion Workout

Stronger Bones

Morning Stretch

Video Chat

Digital Vaults

Chair Yoga

Morning Stretch

Intro to Hosting on Zoom

Functional Strength Training

Fit Fusion Workout

Cloud Storage

Balance/Strength

Morning Stretch

Digital Tools to Boost your Business

How to Choose a New Computer

Podcasts at a Glance

Qigong Flow

Morning Stretch

Reddit at a Glance

IA en todas partes

Taijiquan (Tai Chi)

Stronger Bones

Morning Stretch

Google Workspace

Protecting Your Medical Info Online

Chair Yoga

Morning Stretch

Tech Basics for Caregiving

Functional Strength Training

YouTube

Virtual Tour: The Legacy of MLK Jr. in Washington, DC

Balance/Strength

Morning Stretch

Essential Tech for Running Your Small Business

Booking Rides with Lyft Silver Demo

Digital Tools for Brain Health

Qigong Flow

Morning Stretch

IA y la desinformación

Outdoor Adventure Apps

Taijiquan (Tai Chi)

Saturday Morning Boost: A Fun and Functional Workout

Mobile Health Apps

Online Health Resources at a Glance

Fitness Apps

Good Morning, Senior Planet!

Morning Stretch

Smartphone Camera Uses Beyond Photography

Functional Strength Training

Digital Legacy at a Glance

Stronger Bones

Morning Stretch

Understanding Fraud & Scams

Streaming & Smart TVs

Chair Yoga

Morning Stretch

Understanding Internet Plans

Functional Strength Training

Fit Fusion Workout

Podcasts at a Glance

Balance/Strength

Morning Stretch

Protecting Your Personal Info Online

Website Builders at a Glance

Anti-Virus & Malware Removal Programs At a Glance

Qigong Flow

Morning Stretch

Saving Money with Tech

Generadores de voz y video de IA

Taijiquan (Tai Chi)

Wearables at a Glance

Functional Strength Training

Intro to Sleep Technologies

Getting Started with Insight Timer Demo

Recent Articles

Recent Comments