Aug. 14 will mark the 90th anniversary of Social Security, which provides benefits to 70 million or one in five Americans. And while it has proven to be one of the government’s most stable institutions, that’s not without a ton of public uncertainties about its future.

According to the 2025 Social Security Trustee’s Report, the primary trust fund is projected to be depleted in 2033—no change from last year’s projection. And unless Congress acts, current and future beneficiaries alike will see their benefits cut by 23%.

Analysts have been saying for years that Congress will never let that happen, but Congress still hasn’t acted. What that has meant for many recipients, despite those assurances, is uncertainty. And for some of people who will depend on Social Security income for the rest of their lives it means making decisions – like taking benefits early – that may not be in their best interest over the long term.

Should we be worried?

“That’s the headline that everybody grabs, like, ‘Oh, no, Social Security’s going bankrupt,” says Brian Remson, advanced planning specialist at Credent Wealth Management in Woodway, Teas. “However, that that is not really fair to say, because even in 2035 there’s still going to be enough revenue from payroll taxes to cover anywhere from 80 to 85% of benefits.

“Of course, we understand that and drive an emotion,” he says. “However, they just see a headline and go from there. You can’t fight emotion with facts generally when you’re talking with clients, so you do have to understand the concern.”

Jennifer Belmont Jennings, an attorney and financial planner at MGD Law in St. Louis, Missouri, says she’s not worried, especially for people already receiving benefits. “I’m not personally worried, because they, they will raise taxes, and they will make changes in order to pay the Social Security benefit,” she says.

“I could see them making changes, but I think if social security goes bankrupt and they can’t pay those bills, we have a lot bigger problems on our hands,” she says.

Remson says the solvency of Social Security has been a common question since he has been in the business. “I can fully understand that the more the clients rely on Social Security, the more stress they’re going to have.”

What about younger people?

If anyone should be concerned about their benefits it should be younger people, maybe Millennials and Gen Z. One potential Social Security shortfall is that people are living longer, and thus, drawing benefits longer. Potential solutions include increasing the full retirement (currently 66) and increasing the percentage of your income subject to Social Security taxes (currently $176,100.

Belmont Jennings says younger people should always be preparing for the future and taking planning seriously. “They should be running the numbers to show how much money should I be putting away now to make sure I have what I need later. The sooner you start, the smaller percentage of your income you have to put away in order to get there. All of the math shows that it’s a lot harder to catch up. And so, if you’re putting that money away now, you’re going to be okay no matter what happens.”

Impact of the Trump Budget Bill

The senior deduction bonus has been one of the more confusing parts of the bill. Promoted as eliminating taxes on Social Security, the provision actually gives taxpayers 65 and older an additional $6,000 deduction ($12,000 for married couples). The impact could significantly reduce taxable income.

“I think estimates show that close to 60% of people weren’t even paying tax on Social Security,” says Belmont Jennings. “I think sometimes we forget that most of the country is not ultra-high net worth. So, a lot of people were not paying any tax at all on social security because you have a high standard deduction. And not all social security is taxable anyway.”

Remember: The Social Security Administration is planning to shift from paper checks to electronic payments in September. Learn more here.

Wait till 70?

Keep in mind that the recommendation was never a blanket endorsement of waiting until 70 to receive benefits. Actually, a small percentage of people wait till 70 – only 8 percent.

“I don’t think anything has changed,” says Belmont Jennings. “It’s a very personal decision. People who have a shorter life expectancy, you know you’re not going to make it until you’re 90s, the math is going to show maybe you should start taking that money earlier. If you’re married and you’re still working, it might make sense to at least make sure the person who has the highest potential social security income may still want to wait until the till 70 to collect.

“But I think this is it’s a very personal decision based on your circumstances, based on whether or not you’re continuing to work, based on whether or not you feel like you have that long life expectancy”

“Everybody’s different,” says Remson. “The biggest thing is, is, as you do financial planning, that decision (when to begin taking Social Security benefits) cannot be done in isolation. Pretty much every calculator out there is going to say, you know, wait till you’re 70. However, we have had instances that that, if the client only has IRA assets or retirement assets that are pre-tax, it actually might make sense for clients to take Social Security at full retirement age to provide cash flow versus age 70.”

YOUR TURN

What do you think will happen with Social Security? Add your predictions in the comments!

Stay on top of your finances with Senior Planet from AARP. Join us for live lectures on finance, money management, budgeting tips, articles and more. Check out all our offerings here. Questions? Call our Senior Planet Tech Hotline: 888-713-3495.

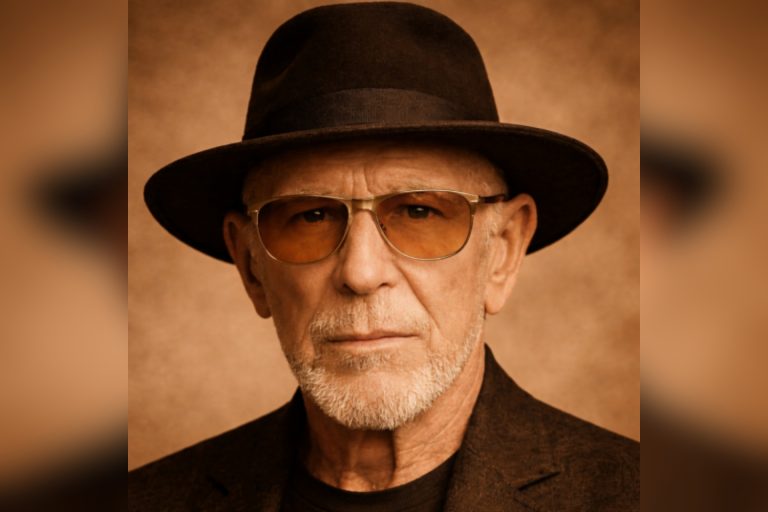

Rodney A. Brooks is an award-winning journalist and author. The former Deputy Managing Editor/Money at USA TODAY, his retirement columns appear in U.S. News & World Report and Senior Planet.com. He has also written for National Geographic, The Washington Post and USA TODAY and has testified before the U.S. Senate Special Committee on Aging. His book, “The Rise & Fall of the Freedman’s Bank, And Its Lasting Socio-economic Impact on Black America” was released in 2024. He is also author of the book “Fixing the Racial Wealth Gap.” His website is www.rodneyabrooks.com

Rodney A. Brooks is an award-winning journalist and author. The former Deputy Managing Editor/Money at USA TODAY, his retirement columns appear in U.S. News & World Report and Senior Planet.com. He has also written for National Geographic, The Washington Post and USA TODAY and has testified before the U.S. Senate Special Committee on Aging. His book, “The Rise & Fall of the Freedman’s Bank, And Its Lasting Socio-economic Impact on Black America” was released in 2024. He is also author of the book “Fixing the Racial Wealth Gap.” His website is www.rodneyabrooks.com

Your use of any financial advice is at your sole discretion and risk. Seniorplanet.org and Older Adults Technology Services from AARP makes no claim or promise of any result or success.

Photo: IB Photography – stock.adobe.com

COMMENTS

Sign Up for Newsletters

There’s always a lot going on in the Senior Planet universe. Get our newsletters to make sure you never miss a thing!

Sign Up Now

Join Senior Planet Community

Senior Planet Community is our social media platform designed specifically for older adult users. Engage in thought-provoking discussions, make new friends, and share resources all on a safe and ad-free platform.

Join the Conversation Today

Upcoming Online Classes

Events

Calendar of Events

Start your week off right with a preview of the week's upcoming programs and a guided meditation session!

Start your day with a short morning stretch!

Registration required.

Where can you find cute pets, news, how-to videos, and more? YouTube, of course! Join us for an intro to YouTube.

Learn how the Nextdoor app can help you connect to neighbors and stay in the know in your neighborhood.

Get your heart pumping during this fun, high-energy workout!

This program is cancelled.

Start your day with a short morning stretch!

Like to know what's happening? Come learn about X (formerly Twitter)!

Ready to get your business noticed online? From SEO to five-star reviews, discover practical strategies to put your business on the digital map!

Follow various cues to develop body alignment and breath awareness.

Start your day with a short morning stretch!

Learn about platforms that make website building a breeze!

Are you paying for TV channels you don't watch? Learn why people are "cutting the cord" and using streaming services instead!

Learn what Podcasts are and where to find them!

Make money while decluttering with online marketplaces!

Start your week off right with a preview of the week's upcoming programs and a guided meditation session!

Start your day with a short morning stretch!

Registration required.

Ready to ditch the filling cabinet and store your documents virtually? Join this lecture on Digital Vaults to learn how!

Tired of juggling paperwork, deadlines, and day-to-day chaos? Discover the user-friendly software tools that can bring clarity, control, and peace of mind to your business.

Make money while decluttering with online marketplaces!

Activate the joints and muscles and increase mental focus during this exercise class.

Start your day with a short morning stretch!

Tour world famous museums from the comfort of your home!

Registration required.

Come learn about QR codes, augmented reality apps, and more!

Want to use AI on your phone? Come explore Google Gemini’s mobile features, from drafting messages to managing privacy.

Start your day with a short morning stretch!

Will your digital content and social media pages live on forever? Come learn about your digital legacy options!

Join Senior Planet and our tour guides from Discover Live for a virtual visit to Croatia!

Can you photoshop that? Come learn the possibilities with photo editing tools!

Get your heart pumping during this fun, high-energy workout!

Activate the joints and muscles to become limber and increase balance during this exercise class.

Start your day with a short morning stretch!

Concerned about viruses and malware? Attend this lecture to learn how to keep your device safe!

Don't want to pay for software? Learn how Google's free tools have you covered.

Curious about your family's history? Fill in the gaps using digital genealogy resources!

Start your day with a short morning stretch!

Be your own DJ with help from Spotify.

¡Venga a chatear con ChatGPT y aprenda sobre IA!

Relax your mind and strengthen your body with this gentle exercise class.

Learn how to stay safe while you surf the web!

Join this session for a fun workout that will boost your strength, flexibility, and mobility!

Need a vacation? Learn about popular websites and apps for booking vacation rentals.

Be your own travel agent with help from these online travel sites!

Leave the dictionary at home and start using digital tools that can translate on the go.

Start your week off right with a preview of the week's upcoming programs and a guided meditation session!

Start your day with a short morning stretch!

Learn tips and tricks to using your smartphone while staying safe!

Registration required.

A simple plan is better than no plan! Get to know a few free and low-cost resources that make it simple to plan your estate.

Interested in taking your cash only business into the digital age? Learn what digital payments are and how to choose among them in this lecture!

Activate the joints and muscles and increase mental focus during this exercise class.

Start your day with a short morning stretch!

Learn about platforms that make website building a breeze!

Don't want to go out? Learn about some popular apps to get food delivered to your front door.

Registration required.

Curious about AI? Come learn the basics, including how it works and considerations to keep in mind.

Start your day with a short morning stretch!

Don't overpay for internet. Learn about programs offering low-cost home internet that can help save you money.

Registration required.

Where can you find cute pets, news, how-to videos, and more? YouTube, of course! Join us for an intro to YouTube.

Learn what Podcasts are and where to find them!

Get your heart pumping during this fun, high-energy workout!

Activate the joints and muscles to become limber and increase balance during this exercise class.

Start your day with a short morning stretch!

Registration required.

Are you scam savvy? Come to this lecture to learn about fraud and scams and how to protect yourself against them.

Explore ways that tech can help you save money and manage your finances!

Learn how the Nextdoor app can help you connect to neighbors and stay in the know in your neighborhood.

Start your day with a short morning stretch!

See who you are talking to with video chat apps!

Aprenda cómo aprovechar al máximo ChatGPT y otros software de IA.

Relax your mind and strengthen your body with this gentle exercise class.

Registration required.

Goodbye floppy discs and USB drives! Learn about cloud storage options that save your files remotely.

Activate the joints and muscles and increase mental focus during this exercise class.

Start your day with a short morning stretch!

Registration required.

Make money while decluttering with online marketplaces!

Discover what you can do with online and mobile banking!

Learn how to make the most out of ChatGPT and other AI software.

Start your day with a short morning stretch!

No car? No problem! Use these apps to help you get around!

Who are Alexa and Siri? Come to this lecture to find out!

Will your digital content and social media pages live on forever? Come learn about your digital legacy options!

Get your heart pumping during this fun, high-energy workout!

Activate the joints and muscles to become limber and increase balance during this exercise class.

Start your day with a short morning stretch!

Say cheese! Learn more about your smartphone's camera.

Registration required.

Faster is not always better! Come learn about home internet options so you only pay for what you need.

Still paying for texting? Use these free apps instead.

Start your day with a short morning stretch!

¡Todo el mundo habla de IA! Asista a esta clase para ver cómo la IA es parte de la vida cotidiana.

Learn how to stay safe while you surf the web!

Join this session to turn your business idea into reality and learn about planning, research, and funding options.

Relax your mind and strengthen your body with this gentle exercise class.

Join this session for a fun workout that will boost your strength, flexibility, and mobility!

Learn how digital coupon tools can help you save money!

Can't find it in the store? Learn about shopping online!

You CAN leave home without your wallet! Learn about popular digital wallets and their many uses.

Start your week off right with a preview of the week's upcoming programs and a guided meditation session!

Start your day with a short morning stretch!

Registration required.

Concerned about privacy? Unsure about accepting cookies? Come learn about some essential privacy tips!

Interested in taking your cash only business into the digital age? Learn what digital payments are and how to choose among them in this lecture!

Get your heart pumping during this fun, high-energy workout!

Activate the joints and muscles and increase mental focus during this exercise class.

Start your day with a short morning stretch!

Ready to get your business noticed online? From SEO to five-star reviews, discover practical strategies to put your business on the digital map!

Goodbye floppy discs and USB drives! Learn about cloud storage options that save your files remotely.

Registration required.

Everyone is talking about AI! Come to this class to see how AI is part of everyday life.

Start your day with a short morning stretch!

Registration required.

Tired of resetting your password all the time? Join this lecture to discover password alternatives and different ways to manage your passwords.

This program is cancelled.

Learn how the Nextdoor app can help you connect to neighbors and stay in the know in your neighborhood.

Get your heart pumping during this fun, high-energy workout!

Activate the joints and muscles to become limber and increase balance during this exercise class.

Start your day with a short morning stretch!

Goodbye Copper, Hello Fiber!

Registration required.

Overwhelmed by the choices of a new computer? We'll help you simplify so you can decide!

Are you paying for TV channels you don't watch? Learn why people are "cutting the cord" and using streaming services instead!

Start your day with a short morning stretch!

¿Podemos realmente creer lo que vemos? ¡Venga a esta clase para acostumbrarse a reconocer la IA!

Love the great outdoors? Come learn how smartphone apps can enhance your outdoor hobbies!

Relax your mind and strengthen your body with this gentle exercise class.

Registration required.

Learn how to use emojis, GIFs, and more to quickly say what you mean!

Will your digital content and social media pages live on forever? Come learn about your digital legacy options!

A simple plan is better than no plan! Get to know a few free and low-cost resources that make it simple to plan your estate.

Ready to ditch the filling cabinet and store your documents virtually? Join this lecture on Digital Vaults to learn how!

Good Morning, Senior Planet!

Morning Stretch

YouTube

Introduction to Nextdoor

Fit Fusion Workout

CANCELLED – Stronger Bones

Morning Stretch

Intro to X (formerly Twitter)

Getting Your Small Business Online

Chair Yoga

Morning Stretch

Website Builders at a Glance

Streaming & Smart TVs

Podcasts at a Glance

Intro to Selling Online

Good Morning, Senior Planet!

Morning Stretch

Digital Vaults

Essential Tech for Running Your Small Business

Intro to Selling Online

Stronger Bones

Morning Stretch

Virtual Museum Tours

Smartphone Camera Uses Beyond Photography

Using the Google Gemini App Demo

Morning Stretch

Digital Legacy at a Glance

Virtual Tour: Split, Croatia

Intro to Photo Editing Tools

Fit Fusion Workout

Balance/Strength

Morning Stretch

Anti-Virus & Malware Removal Programs At a Glance

Google Workspace

Digital Genealogy Tools

Morning Stretch

Spotify

Introducción a la IA

Taijiquan (Tai Chi)

Protecting Your Personal Info Online

Saturday Morning Boost: A Fun and Functional Workout

Introduction to Booking Vacation Stays Online

Online Travel Sites

Intro to Translation Tools

Good Morning, Senior Planet!

Morning Stretch

Safe & Savvy Smartphone Habits

Introduction to Estate Planning Resources & Tools

Digital Payments & Your Small Business

Stronger Bones

Morning Stretch

Website Builders at a Glance

Food Delivery Apps

Intro to AI

Morning Stretch

Affordable Home Internet

YouTube

Podcasts at a Glance

Fit Fusion Workout

Balance/Strength

Morning Stretch

Understanding Fraud & Scams

CANCELLED – Saving Money with Tech

Introduction to Nextdoor

Morning Stretch

CANCELLED – Video Chat

Introducción a chatear con IA

Taijiquan (Tai Chi)

Cloud Storage

Stronger Bones

Morning Stretch

Intro to Selling Online

Banking and Finance Apps at a Glance

Intro to Chatting with AI

Morning Stretch

Ridesharing Apps

Voice Assistants

Digital Legacy at a Glance

Fit Fusion Workout

Balance/Strength

Morning Stretch

Intro to Smartphone Photography

Understanding Internet Plans

Messaging Apps

Morning Stretch

Usos cotidianos de la IA

Protecting Your Personal Info Online

Turning a Business Idea Into Reality

Taijiquan (Tai Chi)

Saturday Morning Boost: A Fun and Functional Workout

Digital Coupon Tools

Online Shopping

Introduction to Digital Wallets

Good Morning, Senior Planet!

Morning Stretch

Intro to Managing Your Privacy

Digital Payments & Your Small Business

Fit Fusion Workout

Stronger Bones

Morning Stretch

Getting Your Small Business Online

Cloud Storage

Everyday Uses of AI

Morning Stretch

Passwords, Passkeys, and More

CANCELLED – Virtual Tour: The Legacy of MLK Jr. in Washington, DC

Introduction to Nextdoor

Fit Fusion Workout

Balance/Strength

Morning Stretch

Staying in Touch as Landlines Change

How to Choose a New Computer

Streaming & Smart TVs

Morning Stretch

¿Es eso IA?

Outdoor Adventure Apps

Taijiquan (Tai Chi)

Emojis, GIFs, and more!

Digital Legacy at a Glance

Introduction to Estate Planning Resources & Tools

Digital Vaults

Recent Articles

Recent Comments